Linking the traditional economy with the crypto economy

Think of the traditional economy which transacts in fiat currency as one highway

Think of the cryptocurrency economy as another highway that intersects the traditional economy, but the two don’t touch

Hence you need on-ramps and off-ramps in order to transaction between fiat and cryptocurrencies

The on-ramp means you pay with US Dollars and you receive cryptocurrency in exchange which is fairly easy to do → there are no shortage of on-ramps for crypto

The off-ramp means that you want to get out of crypto and get back into US Dollars → there are similarly a lot of off-ramps, but in the case of a crash, those off-ramps quickly close off

Hence the creation of the stable coin

What are stablecoins?

Stablecoins: these are cryptocurrencies that peg their value to something external like the USD

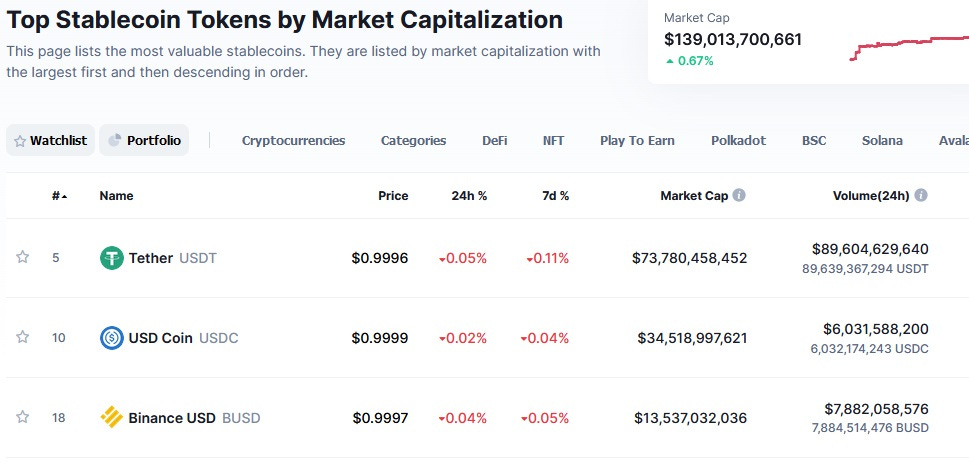

The top two are Tether (USDT) and USD Coin (USDC)

The idea for the most popular stablecoins is that 1 stablecoin = 1 USD and you can use those stablecoins to buy other cryptocurrencies like Bitcoin or Ethereum

These stablecoins are theoretically backed by real fiat currency, so if you exchange 1,000 USD for 1,000 Tether coins (USDT) then Tether keeps those dollars in reserve

Even if the cryptomarket crashes, Tether would still be obliged to reimburse you 1 US Dollar for one USDT because they have that USD in reserve

This is huge for the cryptomarket because it allows people to:

Trade out of volatile cryptocurrencies into a stablecoin very quickly → remember that taking the off-ramp is much slower because it involves the traditional banking system

Cash-out anytime they want to because there is a reserve of fiat currency accessible to them and the stablecoins must redeem 1 USD for every stablecoin

This makes a huge difference in the psychology of crypto investors

At the current moment, the entire crypto market is valued at somewhere around 2.6 Trillion USD…it varies a lot

The stablecoin market capitalization is about 139 Billion USD or about 5% of the total crypto market value

Stablecoin is dominated by a few big players → the top three account for 86% of all market capitalization

These cryptocurrencies are critical for maintaining investor confidence in the market because they ensure you can cash out these stablecoins

Out of these top three stablecoins, all are under an investigation of some sort

Why? Because these stablecoins might not be all that stable

To be fair, USDC is a little more transparent about the reserves backing their coins

But its trading volume is 17% of its market cap

But Tether trades at 120% of its market cap and Binance at 58%

I wonder why?

This is the article that sent me down this rabbit hole

The Bit Short: Inside Crypto’s Doomsday Machine

There’s really no point in me trying to explain in detail what the author writes in this article because I could not do a better job

But I will try to summarize a few key points:

Most crypto trading happens via Tether

Many exchanges, some of which are illegal in the US, have questionable practices such as allowing traders to leverage their positions by up to 100X → How Leverages Turn Market Corrections into Crashes

Tether is extremely opaque in terms of the reserves that back up their stablecoin

For full transparency, a debunk of this piece exists:

Debunking Misconceptions From “The Bit Short: Inside Crypto’s Doomsday Machine”

I agree that the Bitshort author did make some mistakes in interpreting some of the charts, but I’m not sure his conclusions are off.

On the other hand, these are direct quotes from the debunk:

The tether product is for working around the banking system. From a regulatory perspective, this is sketchy by nature. This is also why people use it.

Of course tether is not outwardly “compliant and transparent,” that is the point of tether.

So Tether can only hold it’s value so long as it can satisfy the market that they are willing to buy back 1 USDT in return for 1 USD and so far this has held up

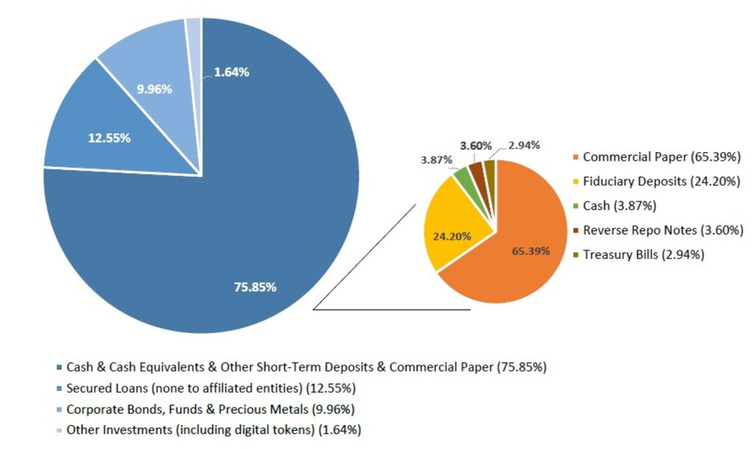

Yet when you look at their breakdown of Tether’s self-reported reserves, you see barely any cash

The most dubious is “commercial paper” which are unsecured short term debt instruments issued by corporations that don’t need to be declared to the SEC

So in this case, Company A would essentially send Tether an IOU for $200 million and get 200 million USDT

Company A would then have to reimburse Tether the amount owed + interest in USDT within 9 months

So who or what is behind Tether?

To answer this question one must read this article by Patrick McKenzie

It’s really an incredible story of some very shady people that have a long history of lying and who have big problems finding banks willing to work with them

There’s Bitfinex which is original company and an exchange which is “closely associated” with Tether meaning they basically own them

There’s also Crypto Capital Corp which allegedly acted as a money launderer for Bitfinex and managed to lose $850 million of their money when their accounts were frozen

What’s happened to some of the associated names:

“Reggie Fowler, who appears to have been the primary architect of Crypto Capital Corp’s money laundering apparatus, was arrested in the U.S. A co-conspirator is at large.”

“Ivan Manuel Molina Lee, who was the President (likely a paper relationship), was extradited from Greece to Poland on suspicion of having engaged in money laundering for drug cartels.”

“Oz Yosef, who Bitfinex’s senior executives dealt with directly (he’s the one they begged for money), was just indicted in New York.”

If you are into cryptocurrencies, then you really need to read these and decide for yourself, because recent mainstream reporting since then confirms a lot of the stank:

WaPo: Opinion: Stablecoins may not be stable. That’s a problem.

Business Insider: Tether slapped with $41 million fine for 'untrue or misleading statements' on fiat currency backing

Bloomberg: Anyone seen Tether’s Billions?

FT: Tether’s bitcoin-backed lending clashes with dollar promise

CNBC: Cryptocurrency firms Tether and Bitfinex agree to pay $18.5 million fine to end New York probe

So then who exactly is purchasing all of this Tether?

Fortunately, the team @Protos did a forensic analysis of the blockchain and have come up with some interesting information

The first conclusion is that Market Makers are the ones who are buying Tether

Can I buy USDT directly from Tether? For the average person no, they only sell it to a select group of clients, the vast majority of whom are “Market Makers”

“The term “market maker” traditionally refers to entities able to profit on the spread of assets (the difference in price between buy and sell orders).”

So these are crypto-exchanges that need stable coins in order to facilitate trading

In fact, the two biggest purchasers of Tether are:

Alameda Research → Sam Bankman-Fried → FTC Exchange

Cumberland Global (upscale crypt exchange) → subsidiary of trading firm DRW → Don Wilson

They account for most of the Tether purchased:

But there are some other interesting buyers of Tether

Tether sent ~ $4.5 billion in USDT to iFinex → That’s pretty weird since Bitfinex and Tether are subsidiaries of iFinex

Tether sent ~ 4.5 billion in USDT to Bitfinex which is affiliated if not the owner of Tether

Tether sent 908 Million in USDT to Delchain which is operated by Tether’s banking partner Deltec Bank and Trust → Delchain then directed 694 million USDT to Bitfinex

So what you have is a pretty opaque system for the creation of large sums of Tether in a relatively short period of time

What does this all mean?

Basically: Tether can basically print money out of thin air

Sure they might have IOUs backing that printing, but it’s all unregulated and has no oversite

Tether still has enough liquidity to pay USD for USTD via the major exchanges

But the moment something happens in the market and investors rush to cash out (the off ramp we discussed earlier), Tether will default very quickly if it’s IOUs don’t pony up

But are we sure that those IOUs are based on USD? What if the IOUs are backed by USDT?

Think about that for a second

An exchange gets 100 million USDT from Tether in exchange for the promise to payback 105 Million USDT in the future…easy enough because if the market crashes you can buy USTD for pennies on the dollar

Or what if exchanges buy USDT from Tether for a small percentage of USD, to keep Tether liquid, and the rest in USTD

But of course we can’t know the truth because Tether refuses any sort of transparency

Their supposed audits are a joke

Cryptocurrency Tether is fined $41 million for lying about reserves

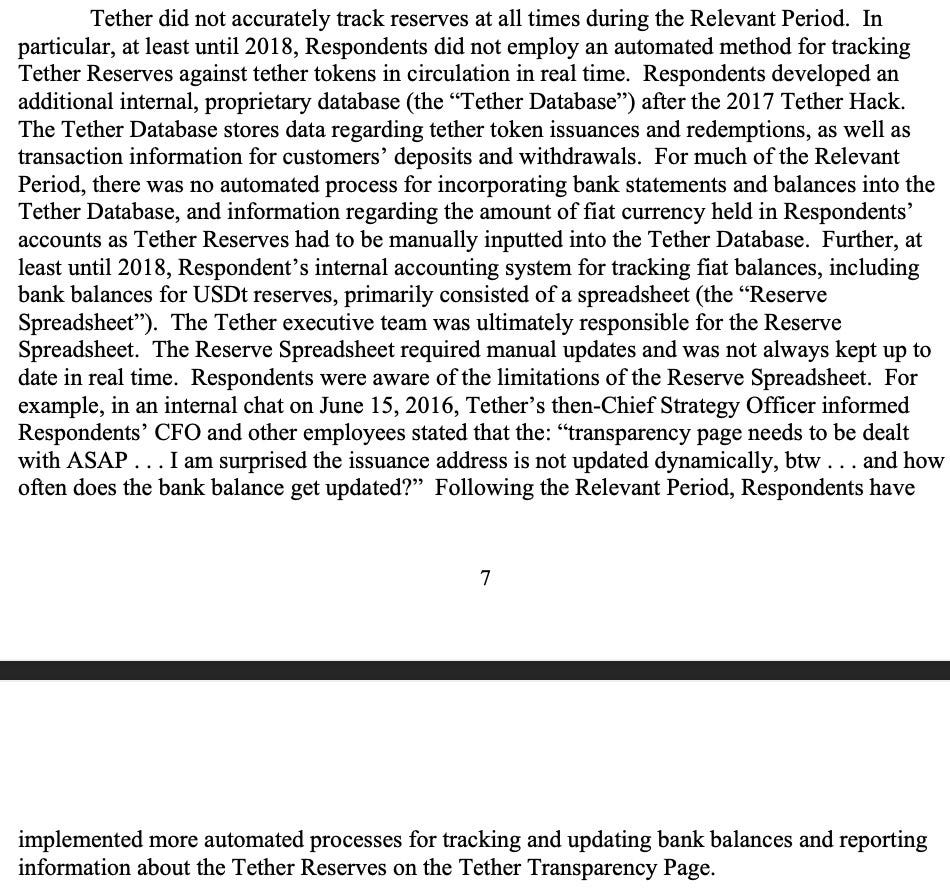

In its enforcement action, the CFTC said Tether failed to disclose that it held unsecured receivables and non-fiat assets as part of its reserves, and falsely told investors it would undergo routine, professional audits to demonstrate that it maintained “100% reserves at all times.” In fact, Tether reserves weren’t audited, the agency said. Until at least 2018, Tether manually kept tabs on its reserve levels, a process that wasn’t updated in real time, the CFTC said. Tether didn’t admit or deny the CFTC’s allegations.

As of 2018, Tether was keeping track of their reserves via an essentially an excel document\ which “was not always kept up to date in real time” according to court records

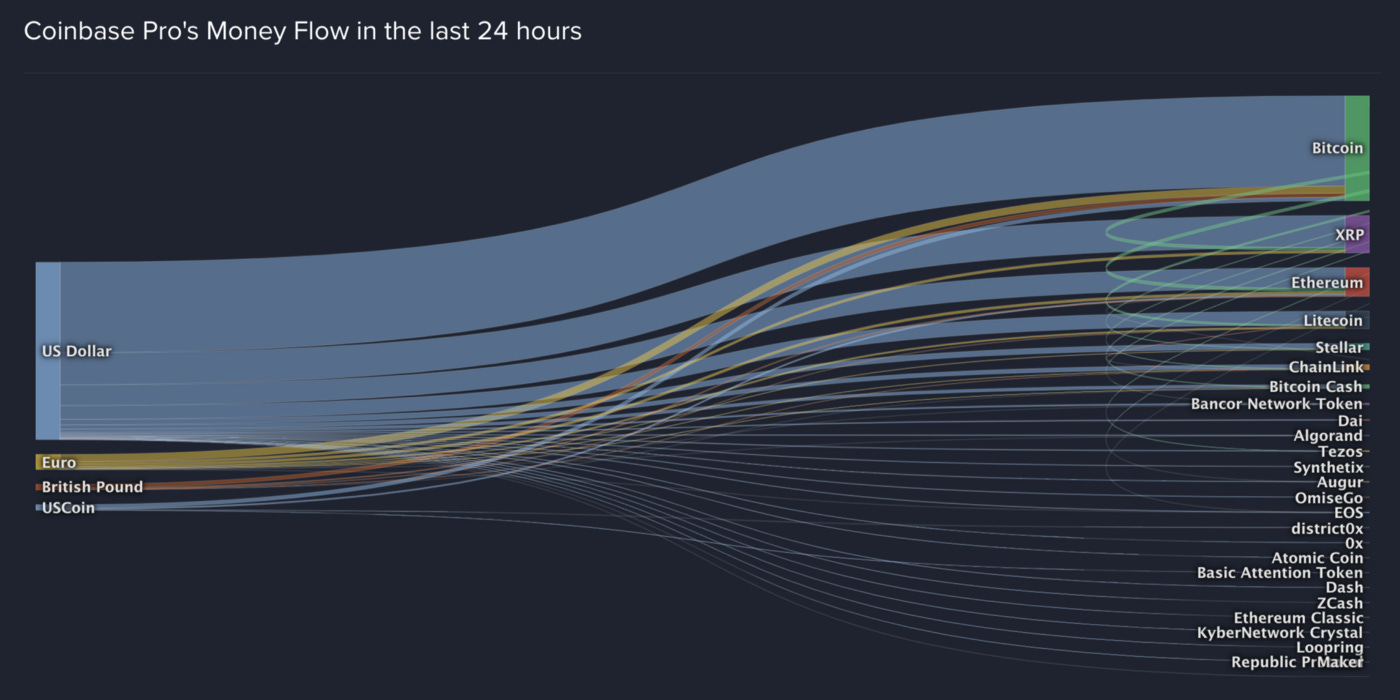

Let’s look at a reputable exchange like Coinbase (from Jan 2021) → Cryotocurrencies are essentially being purchased with Fiat currency:

Btw, Coinbase issues USDC which is audited

But for the other big exchanges, Tether is what’s being used to buy cryptocurrency

If were investing in crypto, I’d immediately cashout upon seeing this

So here’s the risk

There are very few actual US Dollars backing up the huge market capitalization of cryptocurrency

This is why during a period of slight panic/sell off on the market as happened last week, you’ll see the price of USDC (the more trusted stablecoin) jump because panicked investors try to ensure that they can actually cash out

Conclusions

I’m not so sure that a company with the history of Tether can be trusted to be the Treasury Department for the cryptoeconomy

Their ability to print USDT with no regulatory oversight should concern you

Crypto opinion shapers constantly covering for them by yelling “FUD” should make you wonder

The fact that they refuse to open up their books to credible independent auditors should terrify you

Why would big players like Alameda and Cumberland want to purchase stablecoin from a disreputable company like Tether when they could opt for the more secure USDC…

Also, do you guys realize how big the whales you’re up against are?

Tether, Alameda and Cumberland control the market

They can pump and dump at will

The rich folks will not lose money on crypto, but a lot of average people will

I’m not making a judgement on Bitcoin or Altcoin…that future is unclear

But you’ve allowed the cryptoeconomy to be shepherded by wolves

And finally, let’s put things into perspective

There are only around 9 million wallets holding Bitcoin

So 0.12% of the world population has more than $600 dollars in Bitcoin…

Bitcoin has a pretty big market capitalization for something that almost nobody owns

Behind the scenes, Crypto traders admit to me that this is a huge bubble…they know what’s up and manage their risk so they can find an off-ramp in time

To my followers/readers, be careful

Make sure you’ve got an off-ramp because most crypto millionaires are paper millionaires

There is basically very little USD in the crypto market backing up these evaluations

Meanwhile Wall Street is buying up residential houses and apartments in huge numbers

It’s unfortunate that it’s mostly Millennials and Gen Z who are into crypto…they think they’ve found a fast track to generational wealth

But what if Wall Street doesn’t want your crypto as rent for your rental?

Good insight with a few flaws. The biggest, I think, is the # of wallets owning BTC. Lots of folks hold BTC in an exchange and don't take it off exchange. And of course, there is GBTC. The question I would ask is, how many investors have some BTC and how do they hold it? The wild fluctuations are mostly heavily leveraged traders moving in and out.

Agreed, however, Tether is a leveraged problem. I could be cute and say the same about the Banking system and the Fed (25x leverage backed up by...an IOU from a money printer) but that would negate the value of the BTC network (when leveraged by the problem child, Tether).

As an investment, the question you should ask (and that I asked myself) before investing? How much do I risk and how do I evaluate that risk versus the "traditional" investments available to me. When I survey the landscape I see bonds that are artificially kept at low interest rates by the Fed, equities that are inflated by low interest rates by the Fed and skewed by govt policies (e.g. forcing small business to close while Amazon, Facebook, Google, Pharma made bank) and commodities, driven through the roof, again, by govt. policies (e.g. oil, metals, lumber, etc.) The housing market is artificially inflated with low interest rates. Most home owners buy based on what they can afford per month...historically low interest rates during inflation means they can pay more for a smaller monthly payment.

Gummi, have enjoyed your feed and suggest your next deep dive is comparing the choices for an independent investor, or say, a massive pension fund that has to make 7%-9% returns on a weighting of bonds and stocks or possibly default/reduce its "guaranteed" payout. The current global debt is 4x global GDP. The numbers are not sustainable and this weighs on me more than anything tether is doing. Regulation is coming, at least in the US, perhaps causing another BTC/Crypto correction (a la the China FUD, having China out of BTC will be a good thing, btw). I'm guessing, educated guess here, that the regs will most likely decimate the thousands of late-coming blockchain coins. Gensler sort of hinted at that.

In my view, BTC is the Amazon of the early coins through sheer adoption and it's decentralized proof of work is a sight to behold. It has been, will be a bumpy ride, but I don't see anything stopping its continual adoption (similar to Amazon) because it's just better/harder money vs a collection of "eyes wide shut" academics feeding central banks who feed the bankers, at the trough, while the rest of us stand in line.

Thanks for this Gummi - I think your learning about the religious aspect of the crypto world is as fascinating as anything else. Not saying crypto is bad, but its a big red flag.