Gummi Bear's Bitcoin Deep Dive

Is it the future of currency or a speculative bubble?

What is Bitcoin?

It’s essentially a decentralized electronic ledger that keeps track of all Bitcoin accounts as well as transactions

One of its technological achievements is that it was able to solve the double-spending problem without a centralized ledger

How are Bitcoins made?

You “mine” them using powerful computers

Bitcoin mining is the process of creating new bitcoins by solving a computational puzzle

Bitcoin mining is necessary to maintain the ledger of transactions upon which Bitcoin is based

How many Bitcoins are there?

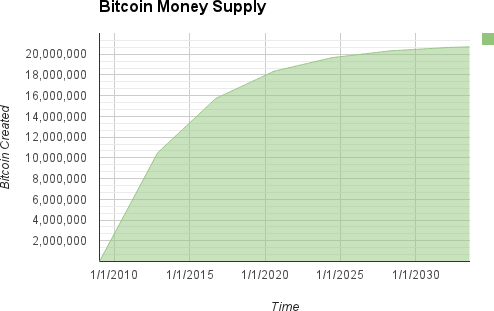

21 million is the total amount

The rate at which they are mined is cut in half every four years until they are all in circulation

All Bitcoin is expected to be mined by 2140

What exactly should Bitcoin be classified as?

Bitcoin is known as a crypto-currency, but it is actually a commodity as defined by the Commodity Exchange Act (CEA)

The closest thing I can compare it to is Gold which is a non-productive asset whose value is solely derived from what someone else is willing to pay for it

This doesn’t mean that non-productive assets can’t appreciate in value, especially if it is rare like artwork, but it doesn’t really have any intrinsic value

What are some of the advantages of Bitcoin?

Simplicity: by eliminating intermediaries, you can easily send Bitcoins around the world in minutes

Anonymity of use: you don’t need to identify yourself when creating a Bitcoin wallet (although people can find out what your key is)

Transparency of transactions: all transactions are contained in the blockchain which is public → you can see transactions in realtime

Cut out intermediaries and centralized government: Bitcoin can’t be taxed or deflated by central authorities

High return potential: the value of Bitcoin grew from ~$5,000 in March 2020 to roughly $60,000 as of today - a growth of 1,200% in about 18 months

Divisibility: Bitcoin is divisible by up to eight decimal points so even though there are only 21 million Bitcoins, it is sufficiently divisible to be used by billions of people

What are some of the disadvantages of Bitcoin?

Volatility: the value of Bitcoin has has huge swings both upward and downward

Unregulated: although this is the point of Bitcoin, it also means that it is vulnerable to pump and dump schemes, scams, and theft → transactions are not reversible so there’s no buyer protection

Wallets can be lost: it happens and some Bitcoin is lost forever

Hard to spend: not a lot of places where you can spend Bitcoin directly for goods and services

Illegal activity: the anonymity afforded to its users makes Bitcoin ideal for criminal activity

Scalability: Because of its limit of 5 transactions per second, it is difficult to be

Energy Use: Bitcoin miners currently consume about 0.55% of global electricity production

So what is the foundation of Bitcoin’s selling proposition?

When I first started looking into Bitcoin, I thought it was more of a political movement…a middle finger to modern monetary policies and global elites

It begins with a rejection of “fiat” money which means that money comes into existence by the decree of some authority → push a button and money created

A little bit of history:

The Bretton Woods Agreement in 1944:

Established that only the US Dollar would be backed by gold, and other currencies would be pegged to the US Dollar

Established the IMF and World Bank to help bail out countries in financial difficulty and invest in developing nations

In 1971, the Bretton Woods Agreement collapsed due to a devaluation of the dollar which saw a run on US gold and the start of stagflation

What happened after 1971 was a new monetary policy that saw increasing inflation as well as a rise in the national debt

This site (WTF Happened in 1971) tries to outline in charts and data, the severe changes to the US economy that resulted from the new monetary policy:

Inflation

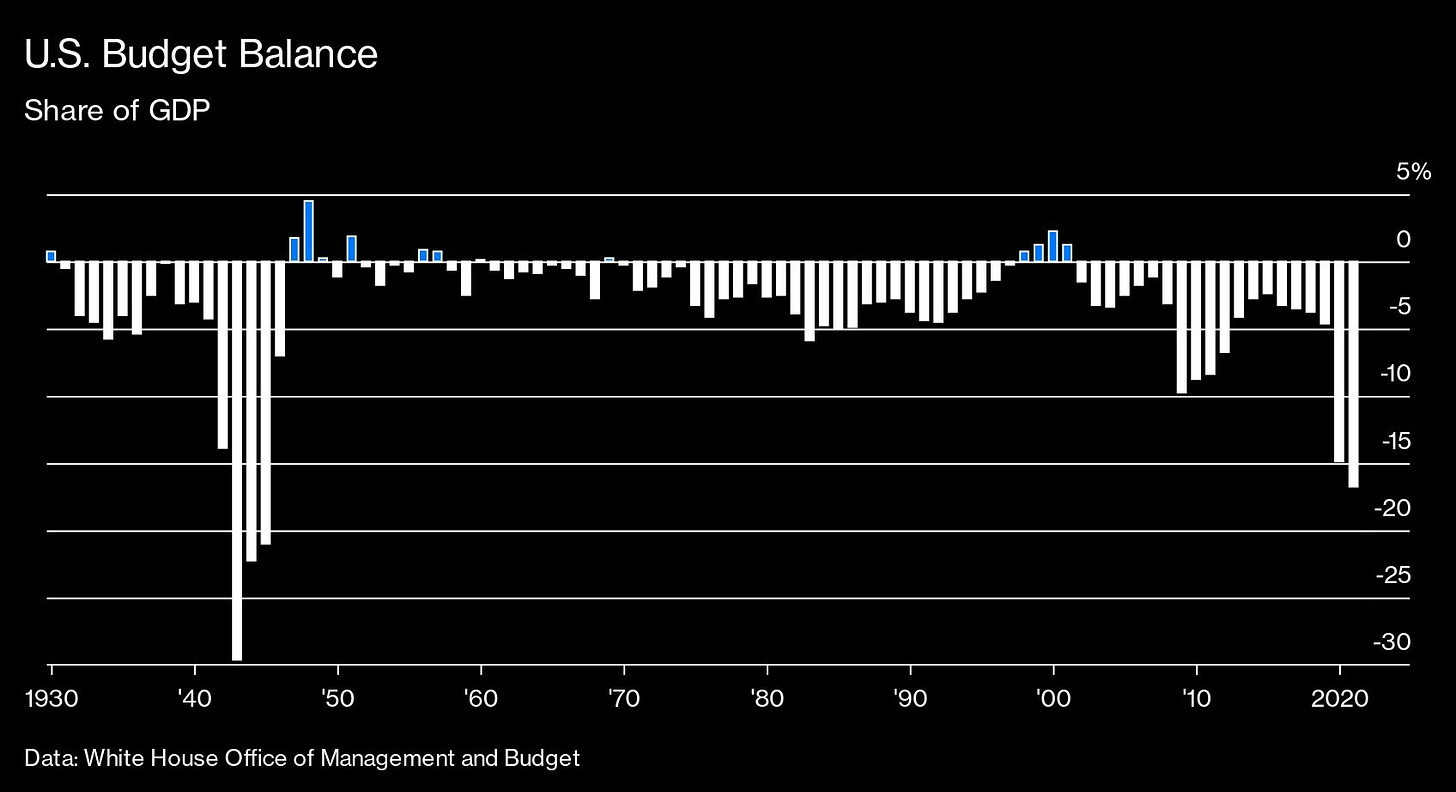

Budget Deficits/Growing National Debt

Stagnation of growth of real wages

Increase in wealth inequality

This graphic of the costs of Campbell’s Condensed Tomato Soup is one example they cite to show inflation:

As one Bitcoin enthusiast said to me: “Fiat money creates hedonism. Spend it before it evaporates. No long-term strategy.”

So Bitcoin’s value proposition to people is:

It is a finite asset that can never increase beyond 21 million Bitcoins

It is the only asset that offers complete ownership, free of any external manipulation

It will retain its value in the face of inflation

It is decentralized so nobody can ever shut it down

It will only continue to grow as more people discover it

So what’s really going on? Modern Monetary Theory vs The Austrian School

To understand the problem that Bitcoiners point to, I’m going to explain Modern Monetary Theory (MMT) first because it makes the exact opposite case about fiat currency than does the Austrian School whose thinking is closely associated with Bitcoin’s

It is considered a fairly radical monetary theory pushed by people like AOC as a means of funding the Green New Deal → it’s rejected even by Democrats

But I’ve looked at it closely and it’s not nearly as radical as people think and folks like AOC don’t really understand it → MMT does not mean that you can print as much money as you want forever and nothing will happen

So what does MMT say?

From Investopedia:

“Core Principles

The central idea of MMT is that governments with a fiat currency system under their control can and should print (or create with a few keystrokes in today’s digital age) as much money as they need to spend because they cannot go broke or be insolvent unless a political decision to do so is taken.

Some say such spending would be fiscally irresponsible, as the debt would balloon and inflation would skyrocket. But according to MMT:

Large government debt isn’t the precursor to collapse that we have been led to believe it is;

Countries like the U.S. can sustain much greater deficits without cause for concern; and

A small deficit or surplus can be extremely harmful and cause a recession since deficit spending is what builds people’s savings.

MMT theorists explain that debt is simply money that the government put into the economy and didn’t tax back. They also argue that comparing a government’s budgets to that of an average household is a mistake.

While supporters of the theory acknowledge that inflation is theoretically a possible outcome from such spending, they say it is highly unlikely and can be fought with policy decisions in the future if required. They often cite the example of Japan, which has much higher public debt than the U.S.

According to MMT, the only limit that the government has when it comes to spending is the availability of real resources, like workers, construction supplies, etc. When government spending is too great with respect to the resources available, inflation can surge if decision-makers are not careful.

Taxes create an ongoing demand for currency and are a tool to take money out of an economy that is getting overheated, says MMT. This goes against the conventional idea that taxes are primarily meant to provide the government with money to spend to build infrastructure, fund social welfare programs, etc.”

This is a fascinating lecture on MMT by L. Randall Wray → I set it to 44:22 which is where he gets into some of the key points, but the entire thing is worth watching:

Apparently, the US Government spent and loaned 34 trillion USD to bail out Wall Street → I haven’t been able to confirm this exact number, but it was at least 14 trillion according to reports I’ve seen

The US government and all countries with fiat currency do spend money with the click of a button and if there is a budget deficit, they issue Treasury securities → the sum of all outstanding Treasury securities is therefore the national debt

And in fact, if we look at how the US and other modern economies have behaved, they do print money and accumulate debt like crazy so to some extent, MMT is already upon us, we just rationalize it differently by pretending we have debt

And the surprising thing is that both Republicans and Democrats have behaved exactly the same → we’ve been deficit spending, and therefore printing money for a long time

The reason I am using MMT as an example is that it is more honest about monetary policies and they aren’t afraid to say the quiet part out loud: The Government controls and arbitrarily manipulates the currency supply, and they believe they can do so in perpetuity

Interestingly, inflation has not been considered a real problem since the late 70s and all the deficit spending we’ve been doing has not really hurt us → although critics would say “not yet”

Inflation has been much smaller than the budget deficits that are run by the US government

This is one of the advantages of the USD being the world’s dominant “global reserve currency” meaning that there is demand for it as a stable currency → as it turns out, almost all countries print their own money and they have greater inflation problems than the US, so the USD is actually relatively stable for them

Critics of this type of system (and Bitcoin advocates) would counter by saying:

Even small inflation adds up over time and diminishes people’s earning

The end result will be hyperinflation, it is just a matter of time

Constant inflation leads to a constant push to incur investment risk in order to stay ahead of inflation → fantastic and well-argued article: Bitcoin is the Great Definancialization

By controlling the currency, the government controls us

We are seeing inflation at the moment after unprecedented government spending:

On the MMT side, they would argue that this is due to:

Global supply chain issues

Worker shortage (which was partially caused by paying people to stay home)

On the Austrian School side, they are saying “We Told You So”, which is one of the big reasons that Bitcoin has exploded since the arrival of Covid-19

Now onto the Austrian School of Economics

I found this summary of the similarities between the Austrian School and Bitcoin:

“What Is the Connection Between Austrian Economics and Bitcoin?

In summary, Austrian economists believe in a free market, opposing intervention from governments while encouraging full economic freedom for individuals.

Also, the thinkers of the school argue that recessions are triggered by central banks that seek to keep interest rates artificially low or high.

It seems like the 2008 financial crisis has proved the Austrians’ points as the Federal Reserve’s easy money policy, artificially low-interest rates, and lack of proper real estate regulation was behind the economic downfall and the recession after.

Similar to what the Austrian school of economics believes in, Bitcoin also promotes financial sovereignty as well as increased privacy and freedom from third parties, such as banks that have been dominating the traditional finance industry.

Furthermore, Bitcoin was created in 2009 in the wake of the global financial crisis. In fact, BTC’s genesis block (the first block ever generated in a blockchain network) included the dated title of a The Times article about the second government bailout of banks during the 2008 crisis.

Also, unlike fiat money, no one can tamper with the Bitcoin supply as the cryptocurrency’s maximum supply is capped at 21 million coins and uses a disinflationary mechanism (the halving event) that cuts the new BTC mined in every block to half.

For that reason, in a theoretical case when Bitcoin gets adopted as the world’s reserve currency, governments would be unable to artificially distort the money supply. From the perspective of Austrian economists, this would minimize (or completely eliminate) recessions triggered by governmental intervention.”

So this is what advocates of Bitcoin say:

The current monetary system is immoral because it essentially enslaves people into constantly having to run after acquiring more and more fiat currency

Inflation through the arbitrary increase in fiat currency is equivalent to theft of your time, work, and property

By controlling the supply of currency, they also control the people

Fiat currency leads to decadence because you must spend the money quickly so you don’t have the ability to make durable long-term investments

Adopting a limited and decentralized money supply, such as Bitcoin, is the only way to break free of the tyranny of increasingly illiberal governments that want to control us

Bitcoin is freedom in the wake of phenomena like The Great Reset and Covid-19 Tyranny

Bitcoin is anti-war because if the people control the currency, they will not agree to fund wars

So what is the better system?

I hope that I’ve done a fair job in trying to explain the two different monetary extremes that are at the foundations of the debate of whether you believe in fiat currency or a decentralized limited supply that Bitcoin supports

I haven’t gotten into the issue of the origins of money, because I just don’t think it is that relevant, but I know somebody will say that I don’t even understand the origin of money…so here’s the difference:

Pro Fiat: Fiat currency is created by decree and it’s almost always been this way → example of Tally Sticks

Pro Bitcoin: No, money is what is mutually agreed upon as being valuable and people can choose their own currency → example is cigarettes becoming currency in prisons

They’re both right so I don’t see this as relevant → fiat currency and gold have co-existed for a long time

What’s my personal opinion?

It’s irrelevant because I’m not an economist, but I will say that I am very sympathetic to the case being made for Bitcoin

And this is the reason why I’ve always seen Bitcoin as a libertarian political movement

But, unfortunately, after a lot of research and thoughtful consideration, I don’t believe that’s really the case

I think Bitcoin is actually one big speculative bubble and I will explain why

Why do I think Bitcoin is a speculative bubble?

There are a number of reasons that have led me to this conclusion

Bitcoin does not actually solve the problem it has described

Are we sure America isn’t being scammed?

Bitcoin is vulnerable to government actions

Institutional investors and whales

The Tether problem

Bitcoin does not actually solve the problem it has described

As it turns out, Bitcoin is not a political movement

They do an excellent job of exposing and criticizing the current fiat system, but what they’re selling doesn’t really solve those problems

They are only replacing one imperfect system with another

Think about it, 89% of Bitcoin has already been mined, and mining the additional 11% is not accessible for normal people

The percentage of people who own Bitcoin globally is impossible to know, but it is a relatively small percentage of people

So what you’re actually talking about is an arbitrary transfer of wealth to a new global elite that owns the 89% of Bitcoin → they now own the majority of the world’s currency…but isn’t that what Bitcoin was trying to solve?

And why should everybody buy into this? Because fiat is bad

If this were a political movement, then one would expect that the goal would be to get Bitcoin circulating among as many people as possible and to encourage Bitcoin to be exchanged for goods and services

Yet the opposite is what has happened

One of the badges of honor in the Bitcoin community is to “HODL” or hold on for dear life

Yup, the Bitcoin community embraces hoarding of Bitcoin and they’re quite proud to do so

According to Investopedia:

“What Is Hoarding?

Hoarding is the purchase and warehousing of large quantities of a commodity by a speculator with the intent of benefiting from future price increases.

The term hoarding is most frequently applied to buying commodities, especially gold. However, hoarding is sometimes used in other economic contexts. For example, political leaders might complain that speculators are hoarding dollars during a currency crisis.

Key Takeaways

Hoarding is the purchase of large quantities of a commodity by a speculator with the intent of benefiting from future price increases.

It is possible for hoarding to create a cycle of speculation, self-fulfilling prophecies, and inflation.

Laws are often passed against certain types of hoarding to prevent tragedies and reduce economic instability.

In the long run, investing in stocks has outperformed hoarding commodities”

Honestly, you want people to not think Bitcoin is a speculative bubble, but you openly admit to engaging in speculative behavior…

On the flip side, one might say that they are HODLing because of a strong belief in the appreciation of the value of Bitcoin → So instead of hoarding out of greed, you are hoarding because you are a true believer which is just as bad

So in essence, Bitcoin advocates are quite good at what they do → They’re generally very intelligent, well documented, well versed in economics and psychology, and they project a level of success and confidence that makes you believe them

Some of them even believe in what they are saying and I covered the intelligent arguments for Bitcoin earlier when I explained the MMT vs Austrian School pro and anti-fiat theories

And social media bubbles can be quite good at reinforcing previously held beliefs while insulating your from other perspectives

It is possible to have interesting intellectual debates about what Bitcoin is and could be within the framework of our society as you’ll see in this chat with Jordan Peterson

But ultimately, it is a bait and switch because Bitcoin in theory has little to do with Bitcoin in reality

And when pushed on the realities of Bitcoin, a lot of these “experts” just talk in non-sense terms

Have a look at Bitcoin guru Michael Saylor explaining why you would want Bitcoin:

"Why would you want it? You'd want it for the same reasons you want to run electric power to your city or you'd want to run running water to your building. Because civilization is based on clean energy, clean water, clean communications, and clean money."

And if you push back with arguments, they tell you that “you just don’t understand it yet”

If you were actually serious about adopting a Bitcoin type of limited supply global currency, the implementation would need to be conducted completely differently

Think of it in this way, there’s really no way to get your hands on new Bitcoin without paying the market price which is around 60,000 USD per 1 Bitcoin

Is that a good risk for average people?

Is hyperinflation that certain?

I don’t foresee it because the USD is the global reserve currency of choice

Crazy spending is not a good idea, but there’s no evidence that it will lead to hyperinflation

And in the worst-case scenario where hyperinflation does occur, the US Government is not going to stand back and allow cryptocurrency to become the new global currency…it can’t

Are we sure America isn’t being scammed?

Let’s look at who is dominating cryptocurrencies worldwide:

Here is a list of countries with the most cryptocurrency users:

India

USA

Russia

Nigeria

Brazil

Pakistan

Indonesia

Vietnam

Ukraine

Kenya

Philippines

South Africa

Bangladesh

Thailand

Now let me ask you: which of these countries is most unlike the others?

Hmmm…the US sure sticks out like a sore thumb

And crypto is conveniently pegged to the dollar…hmm

I wonder how much profound debate about fiat currency is taking place in those other countries?

You might argue those countries have high inflations and therefore store their money in crypto, but it’s more likely that they see it as a way of getting their hands on US Dollars

And are we sure that a lot of low-earning Americans who were stuck at home surfing the internet and social media for over a year, didn’t take their stimulus checks and put them into crypto in the hope of striking it rich?

After all, it is groups like Millenials that own the least wealth that own the most cryptocurrency

And in fact, many Americans have done so well “investing” in cryptocurrencies during the Covid-19 pandemic that they are quitting their jobs because of it!

4% is not a small number when the US is facing such a big worker shortage

When applied against the working-age population, that’s about 6,560,000 people staying home because of their crypto gains while the US is short 10,000,000 workers

That’s a big deal and a big problem for the government

Bitcoin is vulnerable to government actions

The government can not halt the existence of Bitcoin due to its decentralized architecture

But they can easily kill its value

All they have to do is ban its use or exchange for USD

You’re not buying groceries or pumping gas with Bitcoin so if you can’t legally exchange Bitcoin for US Dollars, the value plunges fast

Image these scenarios:

A high death toll terror incident is perpetrated in the US via funding sent by Bitcoin → as national outrage surges government is pressured to ban its use for national security reasons

Somebody from the government gets it into their head that the US worker shortage is due to “crypto millionaires” staying home instead of working → with inflation rising and mid-term elections around the corner, the government bans crypto

But over and beyond anything, the government is never going to abandon the power afforded to them by fiat currency

They can and will do away with Bitcoin before it ever becomes a serious threat

Institutional investors and whales

Institutional Investors

One of the arguments I see for Bitcoin is how serious institutional investors are jumping into Bitcoin

But remember that these institutional investors weren’t shy about trading in collateralized debt obligation of subprime mortgages, or worthless Dot-Coms

The same “institutional investors” are responsible for:

The Wall Street Crash of 1929

Black Monday (1987)

Dot-Com Bubble (2001)

Global Financial Crisis (2008)

Their purpose is to make money and I wouldn’t bet against them after what we saw with the GameSpot controversy

Whether Bitcoin will be worth anything long terms is irrelevant to them so long as they make money, and I’m pretty sure that they will know when to get out of Bitcoin long before the rest of the people do

Whales

Whales are the 2,334 wallets that hold over 1000 bitcoins → In fact, just 4 accounts have 8% of all Bitcoins

Doing a little math we can calculate that these 2,334 wallets own at least 20% of all available Bitcoin → this is if we assume the 2,330 only have 1000 bitcoins

Needless to say, it is a problem in terms of volatility when such large portions of a cryptocurrency

Also, why should large portions of the population agee to enrich these people by buy Bitcoin at unrealistic evaluations?

The Tether Problem

Tether is a type of cryptocurrency that is known as a stablecoin because its value is directly pegged to an external reference point

In the case of Tether, it is pegged to the USD so 1 Tether = 1 USD

More importantly, each Tether is backed by 1 USD held in reserve

Tether is very important for Bitcoin, because it is how traders get into and out of Bitcoin

One of the strategies that Bitcoin traders use is to “buy the dip” so they try to time the right moment to jump out of Bitcoin and then buy it back after it has become sufficiently devalued

They can do this because of stablecoins like Tether which provide stability because they are pegged to the USD

If Bitcoin traders had to exchange their Bitcoin for another cryptocurrency like Etherium, they would be taking huge risks because they can’t predict how stable Etherium would remain moving forward

So Tether is quite important for trading Bitcoin and other major cryptocurrencies because it creates confidence in the stability of their value

The problem is that it is not certain how solid Tether’s reserves are because part of the backing for their Tether coins is in something called “Commercial Paper” which is essentially an unsecured IOU from a corporation

It’s explained here, but in short: if Tether coins are backed by Commerical Paper from the shakey Chinese real estate sector (Evergrande affiliate or others) then the entire crypto market is going to be dramatically affected in a negative way

Final Thoughts

Bitcoin in my opinion is, unfortunately, a house of cards, built on a predictable pattern of behavior by people throughout history

Wrapped in the cloak of new technological innovation, a lot of people have been buying into cryptocurrency as the future of currency

Blockchain technology is undoubtedly very exciting and may very well form the basis for future currencies, but I don’t believe that Bitcoin is it

There are thousands of other cryptocurrencies out there so there’s nothing special about Bitcoin → it was just the first and the most famous…and it’s creator is anonymous which adds a great layer of mystery snd mystique

But it is scarce! So what? There are other scarce cryptocurrencies

If you want to argue that Bitcoin is the only uniquely decentralized platform because there’s not a person that controls it and hence is the only truly scarce crypto → I can concede this point and it doesn’t really change my conclusion

And there are more technologically advanced cryptocurrencies available because blockchain technology is advancing → techies can debate this but it’s not really relavant to the points I’m making

If you want to make the case that Bitcoin is special because it’s actually really fast and uniquely scarce compared to other cryptos, it doesn’t change any of my arguments

These are not sufficiently good reasons for 99% of the planet to trade in their wealth to acquire the majority of Bitcoins owned by the 1%

What is the best-case scenario I can make for Bitcoin?

It could become an alternative to gold as a stable holder of value because it has such a powerful brand and name recognition

But in order for this to happen, it needs to prove that it can maintain a stable value

Unfortunately, Bitcoiners with dreams of it becoming the global currency want to keep pushing its value to the sky

And it is this greed and/or idealism that is ultimately going to sink it because that’s not a realistic objective

It will thus probably crumble under the weight of its own ambition, and a big crash will destabilize the economy because of its huge market capitalization → at that point government will intervene

Can other cryptocurrencies make it?

One of the arguments made for crypto is that out of the Dot-Com Bubble, a number of important companies (Google, Facebook, etc) emerged because of the technology that was developed

So the idea is that all cryptocurrencies can’t succeed but some will make it and make it big

I disagree because the technology here is blockchain, not cryptocurrency

Cryptocurrency, just like fiat money, has no intrinsic value although the technology does

I’m not saying Bitcoin is going to crash soon

Nor am I saying it can’t grow to 2 Million USD

But over a long enough timeline, I think it will lose its value → Some event will occur which will precipitate its crash because there’s nothing particularly special about it

I think people can still make money trading in cryptocurrencies, but they should also have an exit strategy

The older generations which own most of the wealth in the country aren’t going to trade it away for virtual currencies

Now I’m going to get the customary “you just don’t get it” reaction which is fine

But I’ve spent months looking at this stuff and have tried to be as objective as possible in my assessment

So here is my question: If I don’t get it, why do you think the rest of the world will?

Or maybe they should just take your word for it…

Governments will never allow cryptocurrencies sop up their ability to spend by printing money and bonds. Eventually, and I don't think this all that far off in the future now, it will become crime to convert Bitcoin into dollars or Euros without the government getting a huge cut of the dough. The historical comparison you should be looking at is what happened to the gold dollar system in 1933-1975. If at any point the dollar starts to collapse because people are hoarding gold and/or crypto, the governments will simply ban the ownership of those stores of value- it has happened before and it will happen again.

Nice dive Gummi, sad to see your conclusion though.

A few comments:

1. "- Bitcoin mining is necessary to maintain the ledger of transactions upon which Bitcoin is based"

While miners are the ones who sign transactions, the energy they expend is also what secures the network from attacks. (Rather than having the US army do it)

2. Regarding HODLing - this is mostly a first-world phenomena. It makes much more sense to use Bitcoin as your savings account rather than checking account, since it doesn't depreciate like your national fiat currency (just ignore short term volatility). There is a lot more usage of Bitcoin as a medium of exchange in countries like Venezuela, Argentina, Turkey, Lebanon & Nigeria where the currency is collapsing, or in dollarized countries like El Salvador

https://bitcoinmagazine.com/culture/salvadoran-construction-worker-inspired-bitcoin-world

3. Whales

"Whales are the 2,334 wallets that hold over 1000 bitcoins → In fact, just 4 accounts have 8% of all Bitcoins"

Wallet addresses are not users. Exchange wallets hold bitcoin for tens of millions of different users.

4. Blockchain technology - the purpose here is a secure decentralized sequential ordering of events (transactions) -

https://dergigi.com/2021/01/14/bitcoin-is-time/

For centralized cases, a database is much more efficient.

4. Volatility and final thoughts -

Bitcoiners usually point to the history of money from the Austrian perspective because it describes adoption of a new money in stages:

a. Store of wealth - from being a new collectible only a few people value, to a recognized tool for storing wealth with proven transferrable value over time.

b. Medium of exhange - After value is proven, people are willing to exchange their products for the money so that they can spend it later on what they want.

c. Unit of account - The money becomes the standard of how we measure value (As USD does today as the global reserve currency).

Gold went through these phases, and fiat built on its credibility and abstracted away its disadvantages, and once decoupled it just maintainted the facade of having value.

We're now witnessing Bitcoin's adoption from a mysterious cyberphunk project to possibly the world's next reserve currency/asset. That adoption has to include extreme volatility in price terms, otherwise the asset can't prove its value.

But the beauty of it all is that thanks to it being digital, it's happening simultaniously worldwide, with varying forms of adoption. (El Salvador for eg)

Investing/saving is the act of deferring consumption, not stopping it. The early holders will spend their coins when they want to buy something they want more than just holding, like a house for themselves or their children.

You come for the speculation and price appreciation, you stay for the revolution..